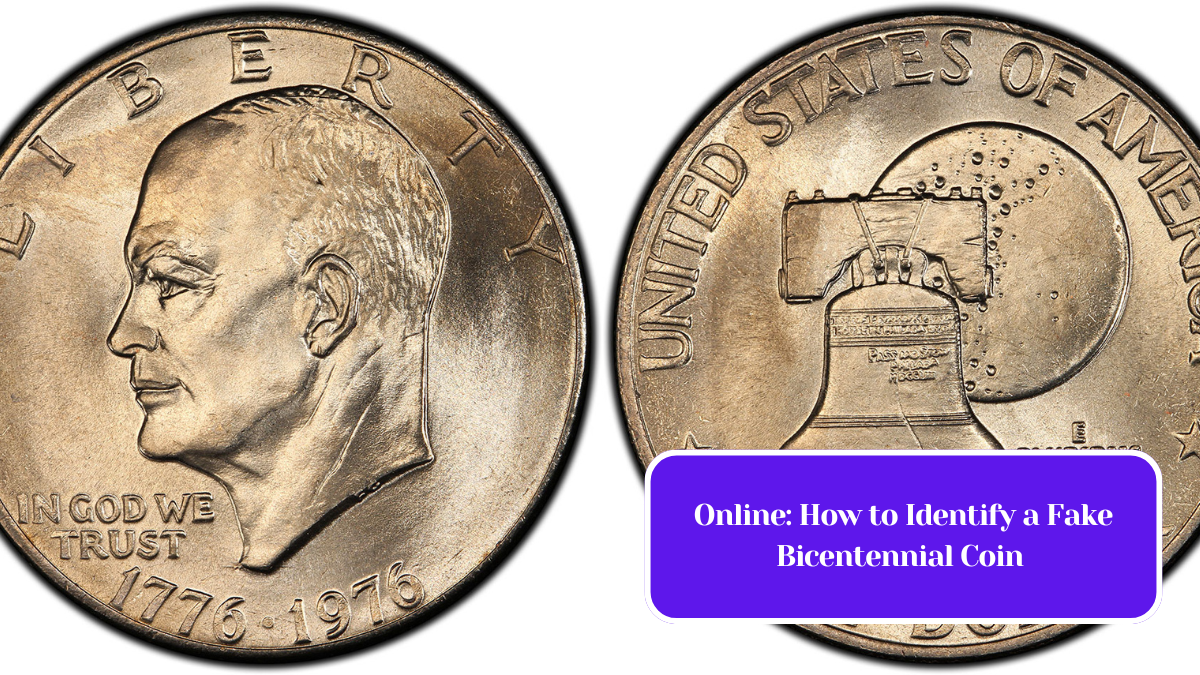

The 1976 Bicentennial coins—commemorative issues from the United States Mint—have become popular among collectors and investors alike. These coins, which celebrate the 200th anniversary of the Declaration of Independence, were produced in a variety of denominations: quarters, half dollars, and dollar coins. While many collectors enjoy these coins for their historical significance and unique design, it’s essential to understand how inflation affects their value over time.

The Bicentennial Coin Series

Released in 1975 and 1976, the Bicentennial coin series featured unique designs: the quarter showcased a drummer boy, the half dollar depicted the Independence Hall, and the dollar coin bore a portrayal of the Liberty Bell. Though minted primarily for circulation, a significant number of these coins were saved by collectors, leading to a large supply in the market.

Understanding Inflation and Its Impact

Inflation Explained

Inflation refers to the general increase in prices and the subsequent decline in the purchasing power of money over time. As inflation rises, each unit of currency buys fewer goods and services. In the context of coin values, inflation plays a critical role in determining both the intrinsic and market values of coins.

The Role of Rarity and Demand

The value of any coin, including the Bicentennial series, is affected by two main factors: rarity and demand. While the Bicentennial coins were produced in large quantities, their historical significance can create demand among collectors. However, as inflation impacts the economy, it can alter how much collectors are willing to pay.

Intrinsic Value vs. Collector Value

- Intrinsic Value: The intrinsic value of a coin is determined by the metal content it contains. For the Bicentennial coins, which are made of copper and nickel, this value has generally remained stable, although fluctuations in metal prices can influence it.

- Collector Value: This value is subjective and can vary based on collector interest, market trends, and overall economic conditions. As inflation rises, the purchasing power of collectors can diminish, potentially lowering the amount they are willing to spend on these coins.

How Inflation Affects Market Prices

As inflation rises, collectors might find themselves less willing to invest in non-essential items like coins, impacting their market prices. Here’s how:

- Decreased Purchasing Power: As the cost of living increases, collectors may prioritize essential expenses over hobby-related purchases. This can lead to reduced demand for Bicentennial coins, causing their prices to stagnate or decline.

- Investment Shifts: During high inflation periods, investors often seek safer assets like gold or real estate, viewing collectible coins as riskier. This shift can further impact the market value of Bicentennial coins.

- Long-Term Perspective: While inflation can affect short-term demand, many collectors and investors take a long-term view. Bicentennial coins may still appreciate over time due to their historical significance and collectible nature, even if short-term fluctuations occur.

Bicentennial coins remain an interesting part of American numismatic history. Their values are influenced not only by their design and historical significance but also by broader economic factors, particularly inflation. While inflation can lead to fluctuations in collector interest and purchasing power, it’s essential for collectors to maintain a long-term perspective. Ultimately, the value of these coins will depend on a combination of rarity, demand, and economic conditions.

Whether you are a seasoned collector or just starting, understanding how inflation impacts coin values can help you make informed decisions in the numismatic market. As always, staying updated on economic trends and collector interests will be key to navigating the world of coin collecting successfully.