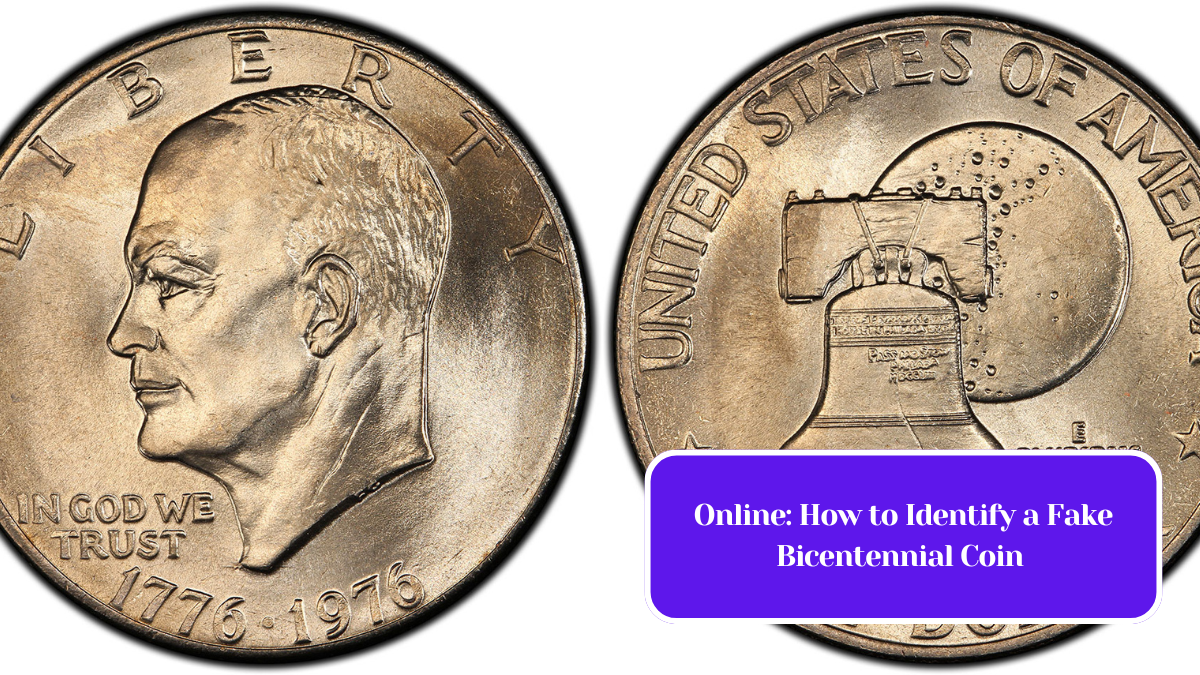

The allure of coin collecting has captivated enthusiasts for centuries, and among the many types of coins available, Bicentennial coins hold a special place in the hearts of collectors. Struck in 1976 to commemorate the 200th anniversary of the United States, these coins, including the quarter, half dollar, and dollar, feature unique designs that celebrate American history. But as the popularity of these coins has surged, a common question arises: Is collecting Bicentennial coins an investment or a hobby?

The Bicentennial Coin Series

Before delving into the investment potential, it’s essential to understand what Bicentennial coins are. The United States Mint issued these coins in 1975 and 1976, featuring designs that reflected American themes. The reverse of the quarter showcases a drummer from the Revolutionary War, while the half dollar features Independence Hall. The dollar coin portrays the Liberty Bell superimposed over the moon. These coins were produced in massive quantities, making them widely available.

The Hobby Aspect

For many collectors, the joy of collecting Bicentennial coins lies in the experience rather than financial gain. Coin collecting can be a rewarding hobby that fosters a sense of community. Enthusiasts often engage in local coin shows, join clubs, and participate in online forums. The thrill of hunting for rare variations, completing sets, or finding coins in circulation can provide a sense of accomplishment and enjoyment.

Moreover, the educational aspect of collecting should not be overlooked. Each coin tells a story about America’s history, culture, and artistry. Collectors often find themselves learning about the historical significance of the Bicentennial and the events that shaped the nation.

The Investment Potential

While many view Bicentennial coin collecting as a hobby, some see it as an investment opportunity. The potential for value appreciation exists, especially for coins in uncirculated or proof condition. However, there are several factors to consider before diving into Bicentennial coins as an investment.

- Rarity and Condition: The value of any coin is largely determined by its rarity and condition. While most Bicentennial coins are common, certain variations and pristine specimens can be worth more. For example, the 1976-S proof coin is more sought after than the standard issue.

- Market Trends: The coin market can be volatile. Prices can fluctuate based on demand, economic conditions, and collector interest. Investing in coins requires a good understanding of market trends and a keen eye for what might become more valuable over time.

- Long-Term Perspective: Like other forms of investing, coin collecting typically requires a long-term perspective. While some coins may see short-term gains, true value appreciation often takes years, if not decades.

- Liquidity: Selling coins can be more complicated than selling stocks or bonds. Finding the right buyer and achieving a favorable price can take time and effort.

Balancing Hobby and Investment

For many collectors, the line between hobby and investment is blurred. Collecting can be both enjoyable and financially rewarding. Many enthusiasts begin collecting simply for the love of it but later find their collection has appreciated in value.

If you’re considering diving into the world of Bicentennial coins, it’s essential to assess your goals. Are you looking to enjoy the hobby and the stories behind each coin? Or are you primarily focused on potential returns?

In summary, collecting Bicentennial coins can be both a fulfilling hobby and a potential investment. While the thrill of collecting lies in the joy of discovery and appreciation of history, savvy collectors can also find opportunities for value appreciation. Whether you choose to pursue it as a hobby, an investment, or a blend of both, the world of Bicentennial coins offers something for everyone.