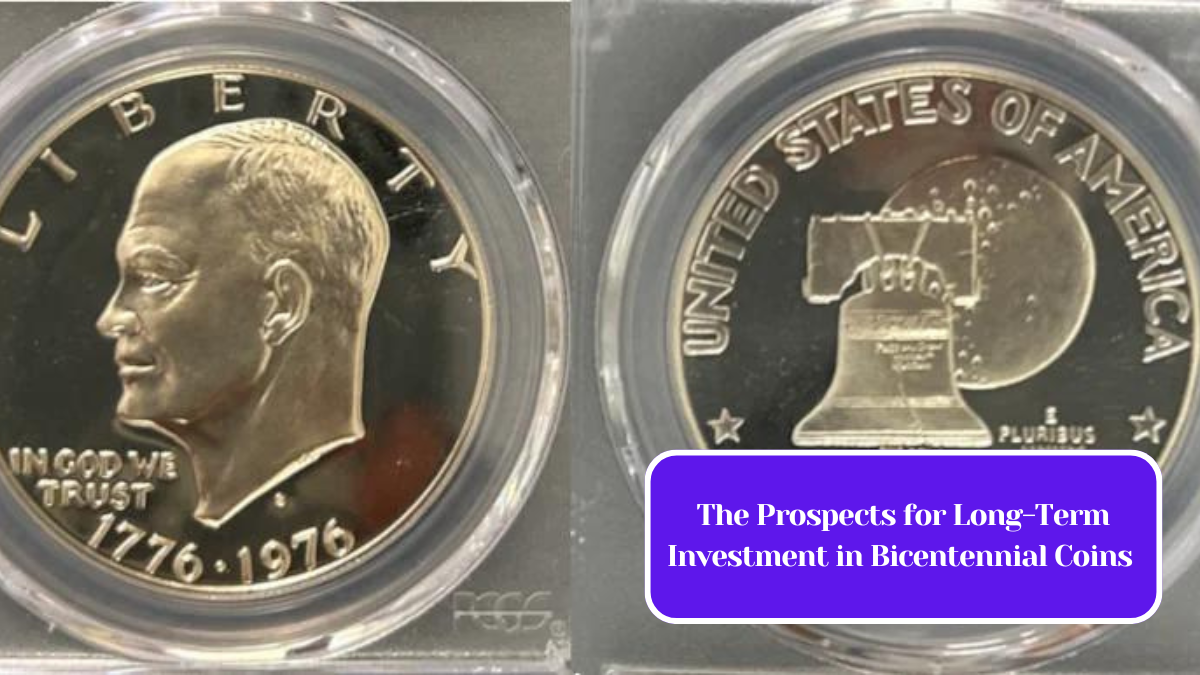

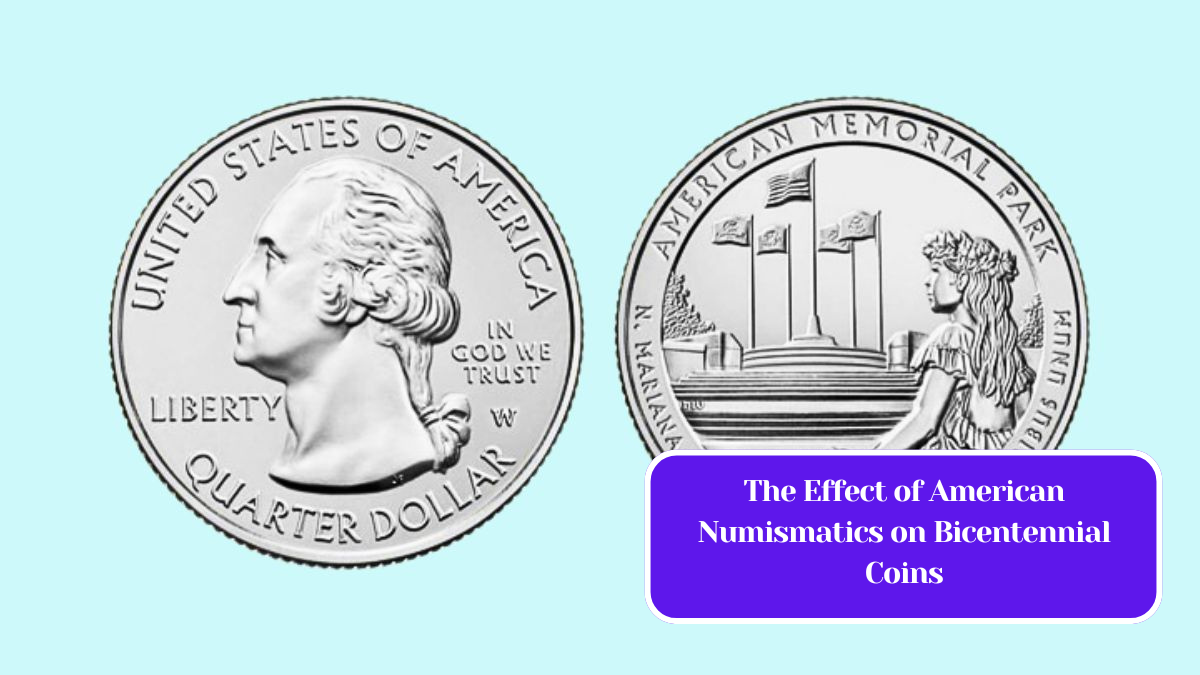

As collectors and investors seek to diversify their portfolios, the market for Bicentennial coins, minted in 1976 to commemorate the United States’ 200th anniversary, presents an intriguing opportunity. These coins, which include the quarter, half dollar, and dollar, have unique features that appeal to both numismatists and casual investors. Let’s explore the pros and cons of investing in Bicentennial coins and what the future might hold.

Historical Significance

Bicentennial coins were issued during a time of national pride, celebrating the nation’s history and achievements. Their release coincided with various celebrations across the country, making them not just currency but also a symbol of American heritage. This historical significance can drive demand among collectors, potentially increasing their value over time.

Limited Mintages

While the Bicentennial coins were produced in large quantities—over 800 million quarters alone—the special designs featuring the reverse side’s patriotic imagery set them apart. The half dollar features a depiction of Independence Hall, while the quarter showcases a colonial drummer. This limited edition aspect, despite high mintage numbers, can attract investors looking for coins with a unique story.

Market Trends

The market for coins can be volatile, influenced by factors such as economic conditions, collector interest, and trends in precious metals. Bicentennial coins, while not made of precious metals (the quarter and half dollar are clad, and the dollar is made of a copper-nickel alloy), can still hold intrinsic value due to their historical and aesthetic appeal. As interest in Americana and collectibles grows, these coins could see a resurgence in popularity.

Accessibility and Affordability

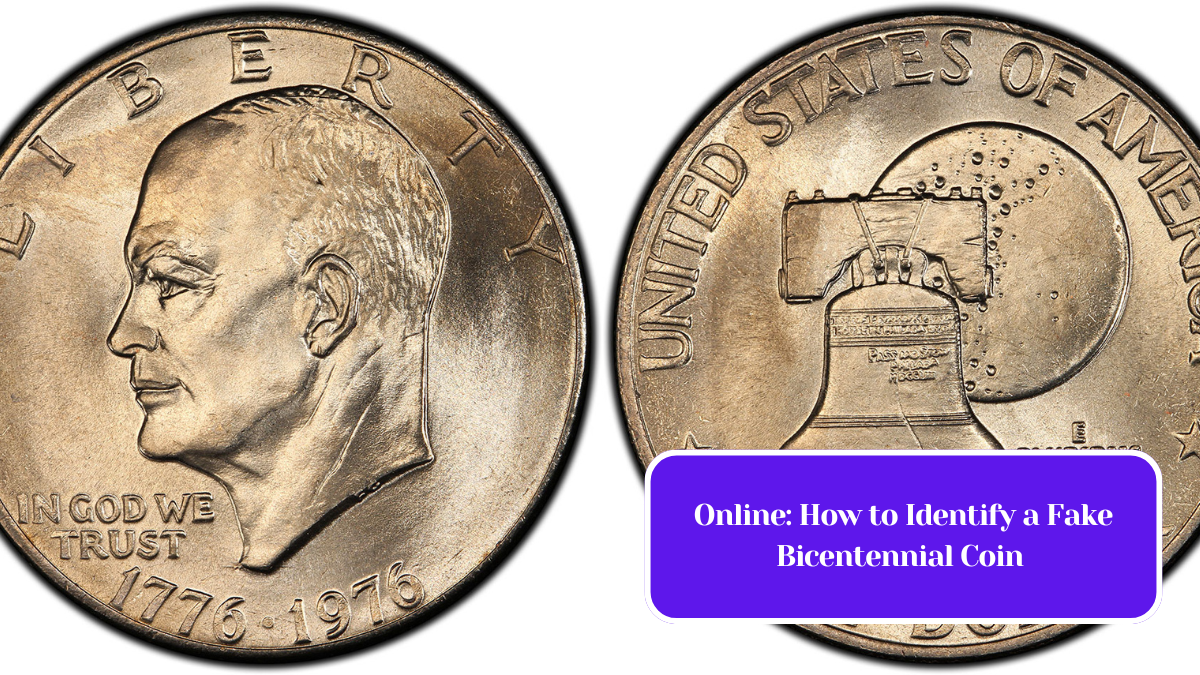

One of the significant advantages of investing in Bicentennial coins is their accessibility. Most of these coins can be found in circulation or easily acquired through online marketplaces and coin dealers. Because they are relatively affordable, even novice collectors can begin building a collection without substantial financial risk.

Diversification Benefits

Adding Bicentennial coins to an investment portfolio can provide diversification. While traditional investments like stocks and bonds fluctuate based on market trends, collectible coins often have their own market dynamics. Including alternative investments like coins can hedge against economic downturns, as collectibles may retain or increase their value when other assets decline.

Potential Risks

However, it’s essential to acknowledge the risks involved in investing in Bicentennial coins. Their market value can be unpredictable, and while they may appreciate over time, they could also plateau or decline. Additionally, the overwhelming number of coins in circulation can dilute their perceived rarity, impacting their value.

Bicentennial coins represent a unique intersection of history, art, and investment potential. With their accessibility, limited edition designs, and historical significance, they are worth considering for those interested in long-term investment strategies. While the potential for appreciation exists, as with any investment, it’s crucial to conduct thorough research and consider both the risks and rewards.

In the evolving landscape of collectible investments, Bicentennial coins may not only hold sentimental value but also the potential for long-term financial gain.